admin@cryptopulse360.com

In the rapidly evolving world of digital finance, a new player is making waves, promising to redefine the landscape of decentralized finance (DeFi) as we know it. Enter Injective Protocol, a cutting-edge platform that’s not just participating in the DeFi revolution but is poised to shape its future. This blog post delves into what makes Injective Protocol a game-changer in the DeFi space and why it might just be the key to unlocking a truly decentralized financial world.

Table of Contents

What is INJ (Injective Protocol) ?

Injective Protocol, often simply referred to as Injective (INJ), is a blockchain network specifically designed for decentralized finance (DeFi) applications. It functions as a layer-1 blockchain, meaning it operates independently and doesn’t rely on another blockchain for its core functionality.

Injective Protocol operates as a DEX, meaning it doesn’t rely on a central authority to hold funds or manage trades. Trades are executed directly between users through smart contracts. The platform supports cross-chain trading, enabling the exchange of assets across different blockchain networks. This is facilitated by leveraging interoperability protocols, making it possible to trade a wide variety of assets not limited to a single blockchain.

Injective Protocol aims to address some of the limitations of traditional financial markets and existing DeFi platforms by offering a more accessible, secure, and versatile trading platform. Its development reflects the growing interest in and demand for decentralized financial services that offer more autonomy and flexibility to users.

What are key features of INJ (Injective Protocol) ?

Injective Protocol is distinguished by several key features that set it apart in the decentralized finance (DeFi) ecosystem. These features are designed to address common challenges faced by traders in both centralized and decentralized markets, such as high fees, limited asset availability, and restricted market access. Here are the key features of Injective Protocol:

- Fully Decentralized: Injective Protocol operates as a fully decentralized platform, meaning that it does not rely on any central authority to control or manage trades. This decentralization ensures that the platform is resistant to censorship, and users have full control over their funds at all times.

- Unique On-Chain Order Book: Unlike some DEXes relying on automated market makers (AMMs), Injective utilizes an on-chain order book system. This allows users to place specific buy and sell orders directly with other traders, potentially offering greater flexibility and control compared to AMMs.Injective caters to users with diverse trading needs by offering features like perpetual swaps, futures trading, and margin trading, which are not commonly found on basic DEX platforms.

- Cross-Chain Trading: One of the standout features of Injective Protocol is its ability to support cross-chain trading. This means users can trade assets across different blockchain networks without needing centralized exchanges as intermediaries. It enhances the platform’s versatility and allows for a wider range of trading pairs.

- High Transaction Speed and Low Fees: Injective sets itself apart with its near-zero gas fees achieved through innovative gas compression technology, establishing it as a cost-effective platform for both users and developers. While the fees are not strictly at zero, they are kept extremely low – a minimal cost of just 0.00001 INJ (approximately $0.0003 USD). Moreover, the Proof-of-Stake (PoS) consensus mechanism based on Tendermint enhances transaction speed significantly. Injective Protocol (INJ) boasts impressive transaction processing capabilities, with reported transactions per second (TPS) ranging between 25,000 and 100,000.

- Multi-VM Support: The Volan upgrade introduced inEVM and inSVM, essentially allowing developers familiar with existing virtual machines from Ethereum and Solana to build on Injective without needing to learn a completely new environment. This potentially fosters innovation and attracts a broader developer base.

- Secure and Trustless: Utilizing decentralized security models and cryptographic proofs, Injective Protocol ensures that trades are secure and trustless. Users don’t have to trust a central authority with their funds or personal information.

- Community Governance: The Injective Protocol is governed by its community of INJ token holders. These holders can propose and vote on changes to the protocol, including upgrades and new features. This democratic approach ensures that the platform evolves in a way that aligns with the interests of its users.

- Byzantine Fault Tolerance (BFT): Tendermint based Proof of Stake consensus is known for this key feature, meaning it works even if a certain percentage of nodes (up to 1/3rd) are offline, malicious, or fail. This makes it extremely robust and secure.

These features collectively make Injective Protocol a powerful and innovative platform within the DeFi space, offering users unprecedented flexibility, security, and control over their trading experience.

How Tendermint-based PoS(Proof of Stake) consensus works ?

You can understand how tendermint based PoS works in following steps.

- Validators: Participants who want to help secure the network stake their coins, becoming “validators.”.

- Block Proposal: At intervals, one validator is randomly chosen to propose the next block of transactions.

- Two-Step Voting: Other validators vote on whether to accept the proposed block in two rounds.

- Finality: Once a block receives enough votes (usually a 2/3rds supermajority), it’s added to the blockchain and becomes almost impossible to reverse.

What are current project that are on Injective protocol ?

Here are some of projects currently leveraging Injective Protocol:

- Helix: This is the premier decentralized order book (DEX) for crypto assets on Injective, offering spot and derivatives trading with features like perpetual swaps, futures, and margin trading.

- Mito Finance: This project provides automated trading vaults and launchpad capabilities for the Injective ecosystem.

- Hydro Protocol: This protocol focuses on liquidity solutions with Real Yield Assets (RYA), aiming to create an “LSD+LSDFi” (Liquid Staking Derivatives + Liquid Staking DeFi) ecosystem on Injective.

The Road Ahead :

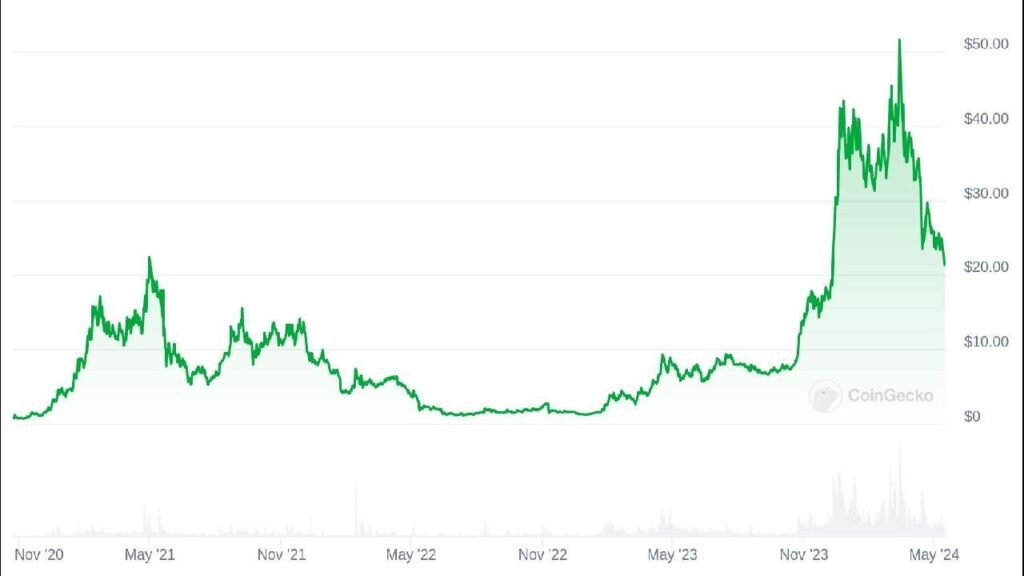

Injective Protocol was launched in October 2020 at an initial token price of $0.40, which has since soared to approximately $40. In the past year, the value of the INJ token has multiplied tenfold. Boasting a market cap of $3.5 billion, the protocol has a total supply of only 100 million tokens, with 88 million in circulation. Despite its remarkable growth, Injective Protocol is still in its early stages, holding vast potential for the future. Additionally, staking INJ tokens offers an appealing APY of 14%.

Looking ahead, Injective Protocol isn’t just part of the DeFi revolution; it’s leading the way, fostering innovation and accessibility. Its combination of speed, security, and user empowerment provides a glimpse into a future where finance is truly inclusive, breaking free from traditional systems.

In this dynamic environment, one thing is evident: Injective Protocol transcends being merely a platform; it signifies a movement towards a more inclusive, efficient, and decentralized financial ecosystem. As we delve into its possibilities, one can only envision the impact it will make on the DeFi landscape and beyond.

In summary, Injective Protocol stands as proof of blockchain technology’s potential to establish a more transparent, equitable financial system. Together, as we embark on this journey, the vision of DeFi appears not just as an aspiration but as an attainable reality, with Injective Protocol leading the way.

Please read my previous blog on Pyth Network , Cex vs DEX, Solana, Vechain and other blogs too.